This Valentine's Day, we bring you a story of frog romance and economics — with a side of math and 1960s game shows. We all know people who make illogical decisions when pursuing love. As a 2015 paper in Science describes, it seems that even frogs can be irrational when choosing a mate. However, in his quest to develop a model for human economic behavior, Paulo Natenzon has found a way to restore rationality to the frogs.

Transcript:

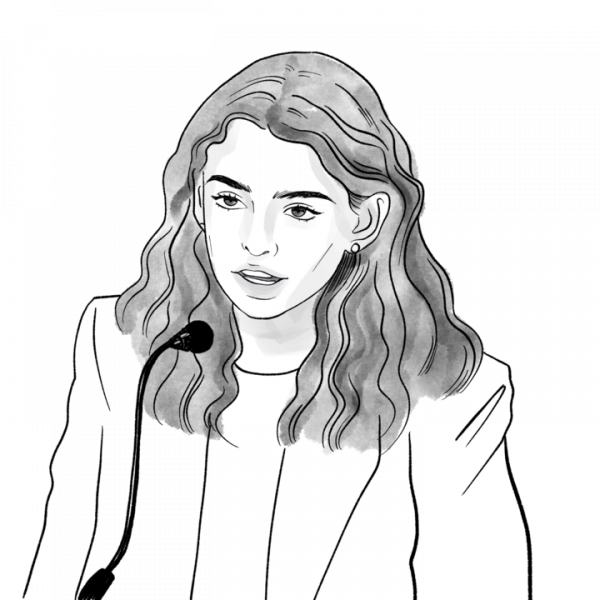

Claire Gauen (host): Thanks for listening to Hold That Thought. I’m Claire Gauen. This Valentine’s day season, we bring you a story of love, economics, and…frogs. Our guest is Paulo Natenzon.

PN: Thanks for having me. I'm Paulo Natenzon. I'm an assistant professor of economics at WashU.

CG: You might be wondering what frogs and economics could possibly have to do with love. Stick with us for a minute, because this unlikely story begins in an unlikely place – an airplane. A while back, Natenzon was on a work trip, flying from Montreal to Philadelphia.

PN: And by pure chance sitting right next to me was somebody I knew before. And this poor guy had the window seat, and I had the aisle seat. So on the flight back I just told him about my research for an hour and a half. He very patiently listened and asked follow-up questions.

CG: The story easily could have ended there. No love, no frogs. But then, a couple weeks later…

PN: He sent me an email, out of the blue, and said, "I thought of you. Your work applies to frogs" and sent me a link to this article in Science.

CG: Oddly enough, this is where the love comes in. For the paper in Science, biologists basically put female frogs in a scientific version of TV show “The Bachelorette.” The female had to choose between multiple options for a mate. And while Natenzon isn’t particularly interested in frog romance, he is very interested in decision-making.

PN: Any economics paper has some model of how individuals make decisions. How consumers and firms choose or make economic choices.

CG: Sure, the frogs in the experiment weren’t making decisions about what to buy or what to invest in. But they were making a very important choice.

PN: The frog experiment is unique because mating choices are, for many people, the gold standard. There's a lot of pressure to get those choices right. And if you think of millions of years of brutal evolutionary pressure, you would expect that the [mating] choices look very rational.

"The frog experiment is unique because mating choices are, for many people, the gold standard. There's a lot of pressure to get those choices right. And if you think of millions of years of brutal evolutionary pressure, you would expect that the choices look very rational."

CG: Whether or not humans behave rationally when choosing romantic partners, well that’s a topic for a different episode. With the frogs, however, the researchers were able to set up a series of experiments to really test this. Given a set of specific circumstances, would the lady frogs behave rationally and choose the best mate? Here’s how the experiment worked.

PN: So, in this experiment, the female frogs are put in a chamber with loudspeakers.

CG: Loudspeakers, because in the wild, the female frogs choose their mates largely based on the suitors’ calls, how they sound.

PN: In the initial experiment, they had two options; one of them was faster and the other one was more attractive.

CG: Through previous research, the biologists knew both these things were important. One, how fast the frogs called. Two, the so-called ‘attractiveness’ of the call, basically the frequency. So the question was, which quality is more enticing for the bachelorettes?

PN: It turns out that the majority of the frogs, in the initial experiment, chose the faster call rate.

CG: So, faster call rate equals better success with the lady frogs. But, there’s a twist. Enter frog bachelor number three.

PN: In another round of experiments, they put the same initial two options, and a third option that was attractive – but he was way, way slower.

CG: We already know that the frogs prefer fast calls. This new guy’s call was super slow. So in this situation, the fast-calling frog should have nothing to worry about, right? Wrong.

PN: In the presence of this third, very, very slow—attractive, but very, very slow—option, all of a sudden, the majority of the female frogs reversed their choice. Instead of going for the fast option, they went for the attractive option.

CG: So, the females did not pick their first choice, the fast frog, or the newcomer, the slow frog. Instead, they picked option number two – the same frog they rejected in the first round. What’s going on here?

PN: These frogs turn out to fall for a phenomenon that is well known with people, which is the decoy effect.

CG: The decoy effect. Here, we’re back to economics for a bit. The decoy effect is basically what we just described with the frogs, when the introduction of a third option – a decoy – causes people or animals to change their mind.

PN: So, decoy effects were found by marketing scientists in the 1980s.

CG: …who found that the decoy effect could influence all sorts of purchases…

PN: Cars, beers, brands of toothpaste, and so on. Since then, the decoy effect has been found in many other settings. People exhibit that kind of puzzling behavior in voting, in medical decision making, in financial investments. So it seems to be something very general. It's very easy to come up with an experiment in which people and animals exhibit the effect. What's hard is to have a good explanation for why it happens.

"It's very easy to come up with an experiment in which people and animals exhibit the effect. What's hard is to have a good explanation for why it happens."

CG (off microphone): So that’s where your theory comes in?

PN: Yes! So it turns out I've been working on this mathematical model of individual decision-making for a while.

CG: In case you didn’t catch that last part, for some time Natenzon has been working on a mathematical solution to this puzzle – creating a model of individual decision-making that helps explain the decoy effect. That’s why his colleague on the plane passed along the paper about frogs. The data about frog mating choices offered a way to test Natenzon’s theory. Without going into all the math behind it, here’s how the model works.

PN: So the model has three components, or tries to make choices realistic in three ways. The first element is the fact that when you make choices, you don't have all the information. So you enter a store, and you're going to buy a new dishwashing machine. You're going to make a decision within a certain amount of time, and with a certain amount of information. You're not going to investigate, in detail, every possible feature that may be relevant to you, right? The same thing with these frogs. They're making this very important decision for them, evolutionarily, which is a mating choice, based on a few minutes of the sound of their call in an environment that is complex – in the dark, under pressure, because there's predators lurking around. So it's natural to assume that, even if they have a very rational preference, because they don't have all the information they need to make sure they make the best choice, sometimes they're going to end up making a mistake.

CG: This idea of having incomplete information is called limited sampling. Now, on to the second element of the model.

PN: The second element is the effect of similarity over how often you make a mistake.

CG: Basically, this is the idea that it’s easier to compare things that are similar, especially if the value of the two things is pretty close.

PN: When you have a small gap in the value of the alternatives, but you make all of the other features the same, in some sense everything that was confusing about this choice cancels out. You see the difference in value very clearly.

CG: Imagine you’re picking out a washing machine. It’s probably easy to tell a terrible one from a high-end one. But if the products are pretty close in value, similar products are much easier to compare. So if two washing machines have all the same features, but one is much more energy-efficient or perhaps a bit lower in price, that benefit stands out. This idea of similarity is the second point of the model. On to number three.

PN: The last element that enters the theory is that, since you have limited sampling and some options that are on the table are easier to compare than others, the decision-maker takes the best possible course of action, given these limitations.

CG: So, according to the model, people or frogs make the best choice available to them, given the circumstances. But remember our dear lovesick frogs. Because of the decoy effect, their choice appears to be irrational – that is, before we think about the effects of limited sampling and similarity. Think back to frog suitor #3, the decoy.

PN: The decoy and the attractive alternative are much closer to each other in every dimension.

CG: In other words, they were similar to each other. And similar choices are easy to compare. The decoy and the fast-talking frog number one, on the other hand, were less similar. Meaning, they were harder to compare. So, in this circumstance:

PN: What would you do? Which frog would you choose? Well, it turns out that choosing among the options that you can compare very clearly is optimal.

CG: The way the math works out – and we’ll get more into the detail of this in a second here – by sticking with the more similar, easier choice, the frogs are actually making the best choice available to them. The best analogy to explain why, Natenzon has found, is through the Monty Hall problem. Maybe you’ve heard of this before; I had not. Monty Hall was host of the long-running game show “Let’s Make a Deal.” In the show, a contestant was presented with three doors.

PN: And behind one of the doors is there's a prize. So here's how it goes. You, initially, can choose a door. So suppose that, initially, I put my hand on door number one.

CG: You choose one door, but you don’t open it yet. Monty Hall then opens one of the remaining two doors.

PN: Because Monty knows where the prize is, Monty can always open a door that has nothing behind it.

CG: Then comes the interesting part. You now have two choices. The door you picked originally, and the one remaining door. Monty then asks you, which door do you choose? Do you want to switch doors?

PN: And the optimal response is, yes, you should always switch doors.

CG: This is a little hard to get your head around, at least for me. There are two options available, 50/50. You’ve already picked one. So why would it matter if you switch? Wouldn’t the odds be the same either way? Not exactly.

PN: If you think about it carefully, you'll realize that, if you stick with the original option, you will win this show, on average, one third of the time. Why? Because you have to get lucky and initially pick the door that had the prize behind. That happens only one third of the time. If you, instead of sticking with your initial choice, you always switch doors, you will win two thirds of the time. Why? Because the only way of not winning when you switch doors is if your original choice was correct.

CG: Which, again, only happens one third of the time. This brings us back to the juicy love story. Though it didn’t appear so at first, by switching her original choice, our frog bachelorette is mathematically making a good choice for her love life.

PN: The same way that optimal behavior is switching doors in the Monty Hall problem, the frogs seem to be doing the optimal behavior of favoring the alternatives that are easier to compare in this data.

"The same way that optimal behavior is switching doors in the Monty Hall problem, the frogs seem to be doing the optimal behavior of favoring the alternatives that are easier to compare."

CG: In the Monty Hall problem, it’s easy to compare the two remaining doors after your initial choice, because, well, Monty opens one of those doors. You know what’s there. For the frogs, it’s easiest to compare the two attractive options. Even though the fast-talking frog is appealing, he’s still only going to be the best choice one out of three times. But wait a second. The Monty Hall problem is hard to get your head around, even for humans. Are bachelorette frogs smarter than humans? Natenzon’s guess is no, but as a species, they have been playing it for a very long time.

PN: So suppose you get the frogs to play the Monty Hall problem, for two million years of brutal natural selection. Any frog that, for any reason, starts switching doors all the time, is going to start winning, or mating with the best choice, two thirds of the time. And, after two million years, only those frogs are supposed to be around. They don't have to be that sophisticated, but their behavior seems to be solving a very sophisticated problem.

CG: So there you have it. Rationality has been restored to the frogs. We wish them, and all of our listeners, the best of luck in finding and celebrating love this Valentine’s Day. As for Natenzon, he’s just thrilled that these frogs offer such a clear example of how his model works.

PN: When I clicked on the Excel spreadsheet that is publicly available on the website of Science Magazine, and I looked at it for a few seconds, and I saw the fact that they did all the pairwise comparisons, and then I realized that the data revealed that frog A and frog C were more similar – then I got the goosebumps. I thought, "I had this definition, this formal definition, of reveal similarity that I wrote years ago!" And I had never found such a beautiful example, such a crystal-clear example, where the data tells you what's going on. So, that was that was a very exciting moment. At that moment, I thought, "OK, that's it, I'm going to have to analyze the data and write about frogs."

"Then I got the goosebumps ... I had never found such a beautiful example, such a crystal-clear example, where the data tells you what's going on."

CG: Many thanks to Paulo Natenzon for joining Hold That Thought. You can find many more ideas to explore on our website, holdthatthought.wustl.edu. Thank you for listening.